Getting approved for an apartment is not as easy as it used to be. Today landlords are using new metrics like credit scores in a complicated algorithm. Also, many frustrated renters who have been declined are upset about losing application fees.

Many large apartment management companies not only won’t negotiate with renters, they aren’t willing to listen to individual concerns that renters express. Let’s discuss what you need for an apartment application. Also list the most common reasons why your application was denied.

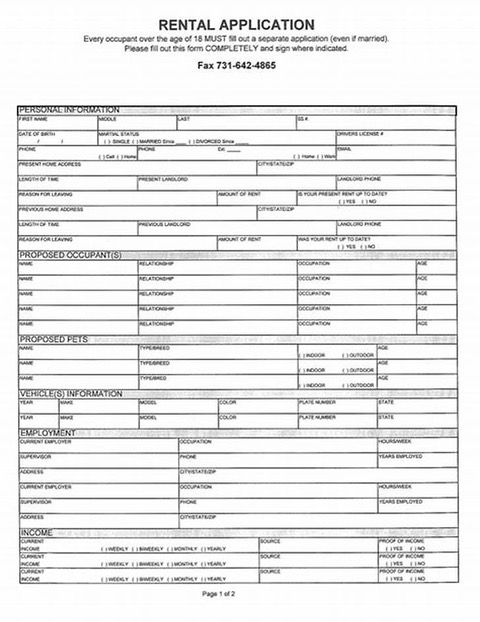

What is an Apartment Application

An apartment application is a document that property management or landlords will use to quality a prospective tenant. In most cases the tenant will also need to provide a form of payment with the document.

Most application fees are in the neighborhoods of $50-$70 per applicant, but they could be more or less.

How to Get an Application

A large majority of apartment communities now include their application online. Renters should be able to fill out and submit a copy. Otherwise, you can always get a hard copy in the leasing office. Many complexes aren’t touring due to COVID-19.

Thus having access to the Internet is a must. All applications must be faxed in or completed on the property’s website.

What You Need for the Apartment Application

The most successful applicants have everything they need to fill out the application quickly. All applicants must also meet the income requirements.

Driver’s license or other identification

You will need your driver’s license number as well as the state that issued it. Also other pertinent info like the expiration date and address. For people that don’t have a driver’s license, they can use state identification.

Social Security #

Almost all apartment communities will want your social. This identifies who you are. Your social security number will be required for the background check.

Your Proof of income

Landlords are going to want to know that you have a job or make enough money to pay your rent. Employment pay stubs, deposits in your bank account, or a tax return should be enough. If you’re starting a new job, you can get a letter from your employer stating your expected income.

Rental History

Larger apartment communities like these in Downtown Houston don’t really care much about your rental history. They are more concerned that you don’t have bad rental history. Smaller communities and landlords will want to contact your previous landlord to see what kind of tenant you were.

Payment a Deposit

When you apply, you will also typically need to leave a deposit to hold the unit. If your application is denied you will receive a refund. Most management companies won’t hold an apartment if you don’t leave a deposit.

❌ Why You Got Denied

Getting denied from an apartment stinks. There is only one good thing about it. You can find out what is holding up the approval. Also you won’t be getting your application fee back. Your deposit should be sent to you in the mail if you paid by check, or possibly be refunded back on your credit card.

In the meantime you probably want to know why you got declined. Here are the top reasons.

- You didn’t meet the income requirements. Most apartment communities want you to make between 3 and 3.5 times the monthly rent. So if the rent is $1000 per month, you need to make at least 3k.

- The background check indicated you have a criminal history. Most larger communities won’t take anyone with a felony. Also misdemeanors are now becoming a constant source of rejection. Always ask the leasing agent about the approval process when it comes to felons and misdemeanors.

- You broke your lease or have an eviction. When you don’t fulfill the terms of your lease, this tells the landlord that you may not pay your rent or you just might leave in the middle of the night. When apartment communities pull your credit report, they can see any other properties that left derogatory marks on your credit report. You may have to rectify the issue before any community will approve you in the future.

- If your previous deposit didn’t cover any damages that you were responsible for, the landlord can take you to court. If not paid, this can be another source of common rejection.

- Bankruptcies and bad credit can also cause applications to be denied. Ask your leasing agent if there is a minimum credit score required.

Take-aways

- When you fill out your apartment application, be sure you have all of the required documentation. This will be your social security number, driver’s license, proof of income, and a form of payment to hold the apartment.

- You can find an apartment application at the properties website or get a copy in the office.

- Rejection happens. If you know that you have bad rental history or don’t make the required income, don’t apply. Usually being honest with the landlord will be your best bet. They can save you the cost of an application fee. Or maybe they will work with you!